EU Levies Russian Wheat Tariffs to Prevent Price Decline

May 3, 2024

Originally published at European Capital Insights on May 3, 2024

Global grain prices have remained stable since the European Commission (EC) recommended increased tariffs on Russian wheat imports to 50% in response to declining local prices across the continent this year.

After the tariff announcement, wheat prices climbed €2 on the Frankfurt Boerse and Euronext, and then they retreated over the following three weeks. European wheat futures are trading at prices seen before the Russian invasion of Ukraine in February 2022.

The Sitagri European Durum Wheat Index price has dropped to €317 from €444 in April 2023, while the Frankfurt Boerse wheat price has dropped to €548 from €676 during the same period. The price spiked to €750 in July last year.

Once the European Parliament votes on the recommendation in coming months the tariffs will become law, assuming a positive vote.

Slowing inflation

The drop in wheat prices in Europe has eased inflationary pressure. The European Central Bank (ECB) reported on April 17 that unprocessed food production, including wheat, slowed to -0.5% from 14.7% a year earlier.

The ECB reported that the annual inflation rate was 2.4% in March, down from 6.9% a year earlier. That matched November’s 28-month low and slightly exceeded its target of 2%, according to Trading Economics.

A rate cut now looks increasingly likely for June, though certain parts of the incoming inflation data still look higher than desired, according to the chief of Germany’s Bundesbank, Joachim Nagel. He told CNBC that a rate cut was likely despite core inflation and service inflation remaining “high.”

Inadvertently, Russian and Ukrainian wheat imports to Europe have combined to moderate inflation across the bloc. Grain prices have declined as Russia produced a record amount of wheat from 2021-2023, according to the latest U.S. Department of Agriculture Foreign Agricultural Service (FAS) report of April 11.

Russian Production and Ukrainian Resilience

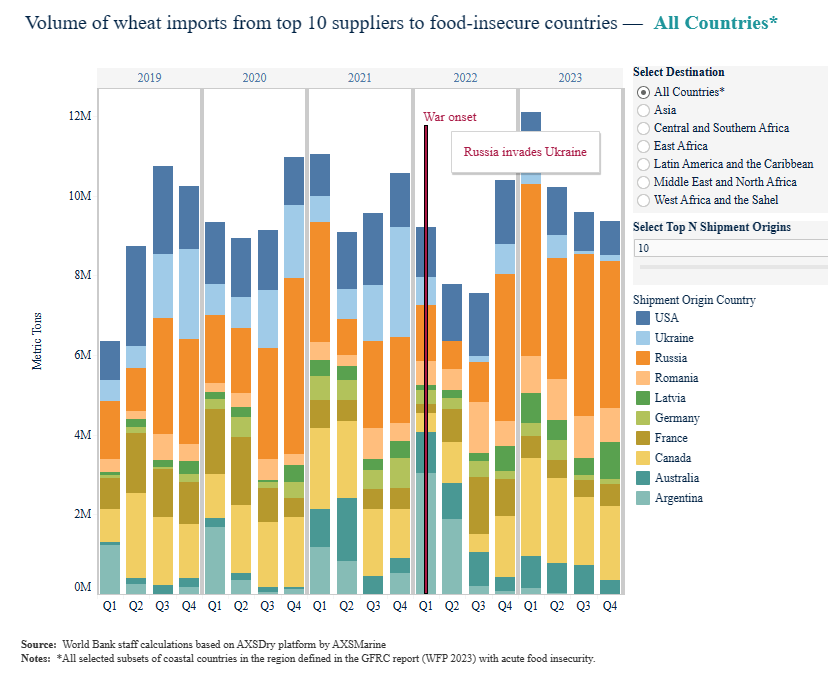

Russian production increased 15% to 92 million tons per year during the two-year period. Ukrainian supplies have also remained stable. Russia was the largest global wheat exporter in 2021 and has remained so. Ukraine was fifth, just behind the entire EU taken as a bloc, Australia, and the U.S.

After the Russian invasion of Ukraine, global wheat prices spiked given concerns Ukrainian grain would be taken off the market, raising fears about famine in countries that relied heavily on grain imports from both countries. The European Union (EU) and the U.S. blamed Russia’s invasion for the price spike in 2022, while African countries warned that it was Western sanctions threatening food supplies.

To alleviate concerns about global food supplies, the United Nations and Turkey brokered an agreement between Russia and Ukraine that allowed wheat exports. Russia pulled out of the deal in July 2023, claiming that the terms of the agreement had not been fulfilled to merit a further extension.

Ukraine, however, started exporting wheat through alternative inland waterway routes. Ukrainian and international grain ships took on grain in smaller Danube delta ports instead of the major port of Odessa on the Black Sea, and then exited the Danube and proceeded through Romanian, Bulgarian, and Turkish coastal waters under NATO protection through the Dardanelles.

European Commission Response to Farmers’ Protests

Ukraine has continued to export significant amounts of wheat by sea, as well as by rail and truck through “Solidarity Lanes” established by the EU. Ukrainian grain and oilseed exports, while diminished, continued at a steady level of 2-3 million tons per month, according to the EU.

The infusion of Ukrainian grain into Europe disrupted local markets, leading to protests across Europe as farmers protested against lower prices for their wheat.

European farmers held large scale protests throughout Europe to protest Ukrainian exports in February and March, with Poland, Hungary, and Slovakia, announcing outright bans of local Ukrainian grain sales.

Brussels responded by initiating the process to levy tariffs on Russia instead of Ukraine, out of concern that even greater market disruption could result if cheap Russian grain was allowed access to the common market. The bloc may forestall immediate grain price declines in Europe due to its tariffs on cheaper Russian wheat. Russia may redirect its supplies to global markets.