AI Will Help Drive EU Electricity Demand

May 15, 2024

Originally published at European Capital Insights on May 15, 2024

Electricity demand in Europe is forecast to increase by as much as 50% in the next decade as traditional and Artificial Intelligence (AI) data centers as well as electrification plans are rolled out across the continent, reversing a 15-year decline in consumption.

The rapid expansion of data centers and a pick-up in electrification in transport, industrial processes, and buildings could boost Europe’s power demand by 40% in the next ten years, according to Goldman SachsElectrify Now report published in April. A bull case for AI data centers could see electricity consumption growth at 50%.

The European Union (EU) launched the RePower EU plan in May 2022, funneling around €300 billion in grants and loans through the Recovery and Resilience Facility. The plan aims to spur power demand, which will be magnified by the “needs of data centers,” the report also showed.

EU policies to reduce carbon emissions or the transition from gasoline to electric vehicles (EVs) didn’t result in annual increases in electricity demand. Instead, consumption dropped 10% from 2008-2023, Goldman Sachs said, citing Ember-Climate, an independent energy think tank.

“Europe’s power demand has been severely hit by exogenous shocks,” Goldman Sachs said, pointing to the global financial crisis, the COVID-19 pandemic lockdown, and Russia’s invasion of Ukraine.

The AI Game Changer

AI is expected to be an electricity consumption game changer.

Globally, data centers’ total electricity consumption could reach more than 1,000 terawatt hours (TWh) in 2026, compared to 460 TWh in 2022, according to the International Energy Agency (IEA).

Scientific American, the oldest continuously published magazine in the United States, reported that if NVIDIA Corp. shipped 1.5 million AI server units per year by 2027, at full capacity, they would require at least 85.4 TWh of electricity annually.

Demand from retail customers for cloud storage, social media, and movie streaming could add about 220 TWh to Europe’s electricity consumption in the next 10 years, Goldman Sachs wrote.

As machine learning models, such as ChatGPT, become more advanced, the computational power required to develop them has doubled every five to six months since 2010, according to the IEA. AI data centers consume approximately 10X the power of traditional data centers, and global data center demand is booming.

Underscoring AI’s need for power, Microsoft Corp. posted a job description in September seeking a nuclear technology expert to lead the company’s technical assessment for integrating small modular nuclear reactors and microreactors to power the data centers for Microsoft Cloud and AI.

Data Center Challenges

The expected increase in electricity demand comes as a European data center shortage worsens, according to data center research at CBRE. Amazon Inc., Alphabet Inc., and Microsoft are looking in Europe for carbon-free energy to meet that demand.

European regions with a strong presence in financial services and acting as big tech hubs could take a larger share of the data centers pie. Countries offering incentives to attract data centers and support faster electrification technology adoption could benefit from a larger share.

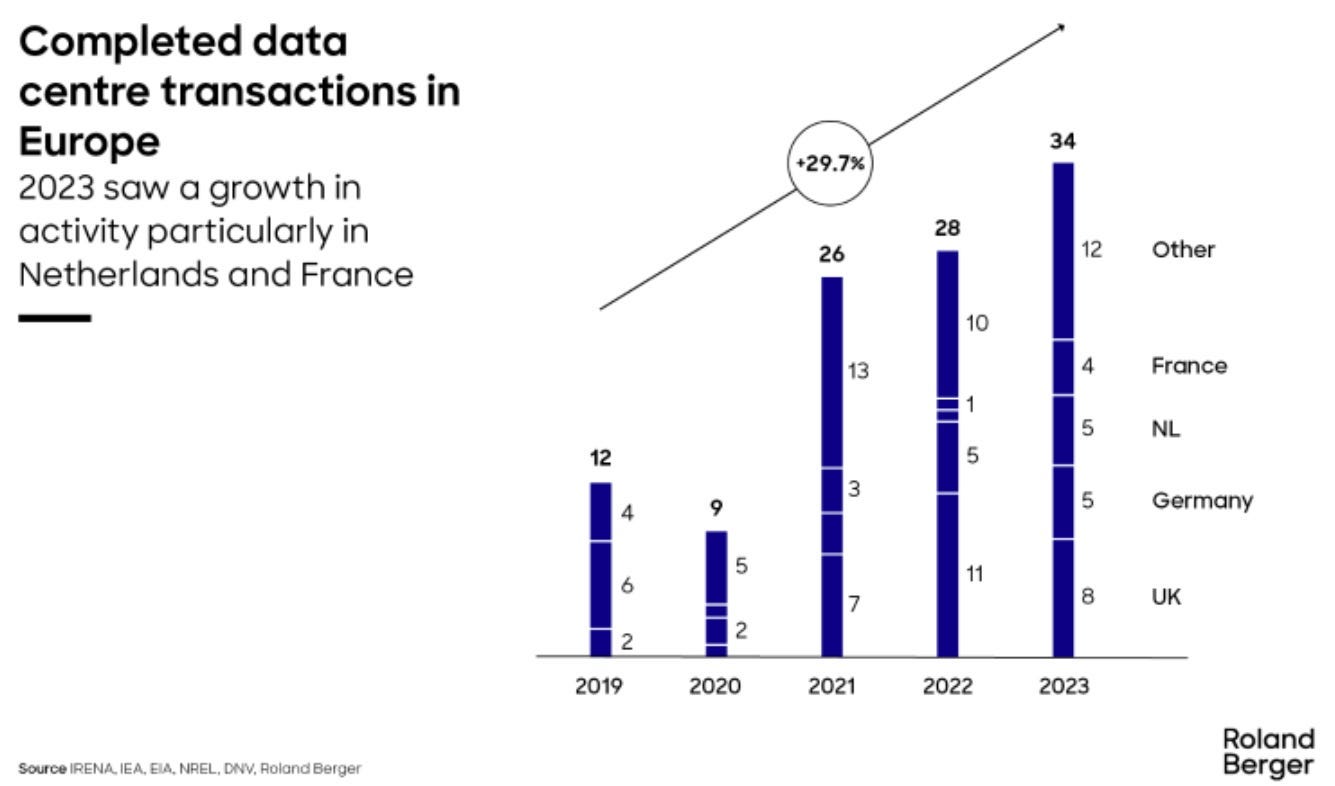

European data center capacity is relatively concentrated and is mostly located in the Nordics, Frankfurt, London, Amsterdam, Paris, and Dublin (FLAP-D). According to Roland Berger, a Munich-based global management consultancy, demand for the FLAP-D markets grew almost 30% in the past three years.

SAP Is Well Positioned

Analysts are pessimistic that European companies will be able to compete with their US counterparts. Lagging technology largely explains why major European firms are underperforming their US counterparts, McKinsey Global Institute said in 2022.

Two companies that may buck the trend are German-based SAP SE (SAP), the biggest AI company in Europe, and France-based OVHcloud (OVH.PA), the largest provider of cloud services in the region, with over 1.4 million users and 30 data centers across four continents.

With a market capitalization of over $220 billion, SAP has enough liquidity to invest in technologies and sustainable practices and could further strengthen its position by adopting advanced energy solutions in its data centers.

Over the past year, SAP generated $31.8 billion in revenue and 7.65 billion in EBITDA, producing a profit margin of over 15% and yielding a free cash flow of 18%.

OVHCloud

Despite its share price being down 27% year-to-date (YTD) and 66% since listing in 2021. OVH’s revenue has increased year-on-year from 2019 and is projected to increase at 11.3% per year. Earnings growth is expected to soar over 100% annually.

OVH said it expects profit margins to increase by over 37% in 2024 due to recent efforts to cut costs and raise the prices of its services.

The company said it plans to launch a new data platform to facilitate customer data projects, an AI endpoint service to enable API-based AI, and an AI App Builder with market-standard AI solutions in its attempt to offer more value for customers’ investments.